Split

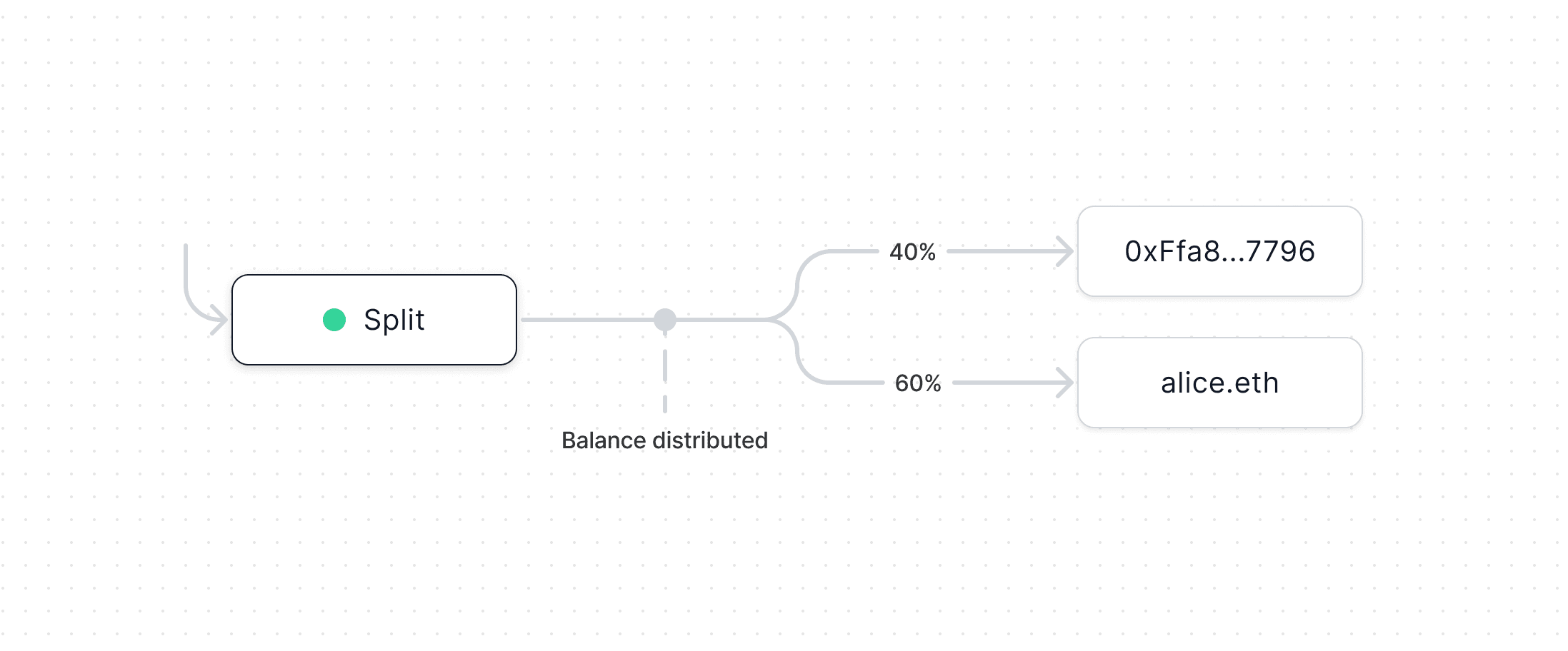

Split acts as an equity instrument by letting you define the percent of future value each recipient will earn. It's a payable smart contract that distributes all ETH & ERC20 tokens it receives among recipients according to pre-set ownership percentages.

- Create at split.new (opens in a new tab)

- Github (opens in a new tab)

- Contracts & Natspec (opens in a new tab)

- SDK

- Example (opens in a new tab)

- Audit (opens in a new tab)

How it works

- Each Split is a payable smart contract with two more more recipients. Each

recipient has an address and an ownership percent. ETH and ERC20s sent

directly to the Split are held in the Split's balance until

distributeETHordistributeERC20are called. - Recipients, ownerships, and keeper fees are stored onchain as calldata and re-passed as args and validated via hashing when needed.

- Each Split gets its own address and proxy for maximum composability with other

contracts onchain. For these proxies, we extended

EIP-1167 Minimal Proxy Contract (opens in a new tab) to

avoid

DELEGATECALLinsidereceive(), allowing for Splits to accept hard gas-cappedsends&transfers. SplitWallet(opens in a new tab) is the implementation logic forSplitProxy.SplitProxydelegates all calls toSplitWalletother than handlingreceive()itself to avoid the gas cost withDELEGATECALL. All funds pile up inSplitMain(opens in a new tab) untilwithdrawis called for a recipient.- We recommend reviewing the contracts flow of funds.

⚠️

Splits do not work with non-transferable, fee-on-transfer, and rebasing tokens.

- Non-transferable tokens will be stuck in the Split forever.

- Fee-on-transfer tokens will distribute, but not all recipients will be able to withdraw their share.

- If a rebasing tokens supply decreases, not all recipients will be able to withdraw their share. If the supply increases, the incremental yield will be lost and stuck in Split Main.

Addresses

Ethereum – 1

Optimism – 10

BSC – 56

Gnosis – 100

Polygon – 137

Fantom – 250

Base – 8453

Arbitrum – 42161

Avalanche – 43114

Zora – 7777777

Aurora – 1313161554

Blast – 81457

Celo – 42220